Apple Stock Holders: Who Owns Apple and Why It Matters

Understanding who the Apple stock holders are and the distribution of Apple’s (AAPL) ownership is crucial for investors, market analysts, and anyone interested in the financial health and strategic direction of one of the world’s most valuable companies. This article delves into the major Apple stock holders, examining the influence they wield and the implications for the company’s future.

Institutional Investors: The Dominant Force

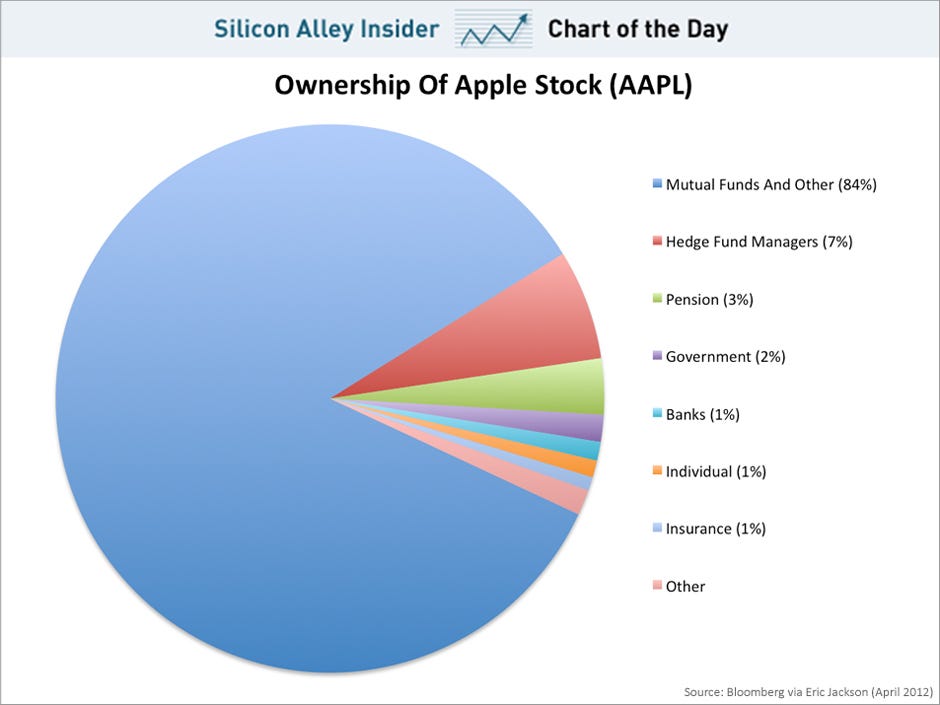

Institutional investors, such as mutual funds, pension funds, and hedge funds, collectively own a significant portion of Apple’s outstanding shares. These entities manage vast sums of money on behalf of their clients and often take long-term investment positions. Their decisions can heavily impact Apple’s stock price and overall market sentiment.

Top Institutional Holders

- Vanguard Group: Vanguard is consistently among the largest Apple stock holders. Their index funds and exchange-traded funds (ETFs) hold substantial AAPL shares, reflecting their broad investment strategy across the market.

- BlackRock: Another major player, BlackRock, holds a significant number of Apple shares through its iShares ETFs and actively managed funds. Like Vanguard, their investment in Apple underscores the company’s importance in the global economy.

- State Street Corporation: State Street, through its SPDR ETFs, is also a prominent Apple stock holder. Their large holdings reflect the popularity of index investing and the importance of Apple within major market indices.

- Berkshire Hathaway: While not strictly an institutional investor in the traditional sense, Warren Buffett’s Berkshire Hathaway maintains a substantial stake in Apple. Buffett’s investment is noteworthy due to his value-investing approach and long-term perspective. He views Apple as a company with a strong brand, loyal customer base, and consistent profitability.

Influence of Institutional Ownership

The high level of institutional ownership in Apple has several implications:

- Stability: Institutional investors often hold shares for the long term, which can provide stability to Apple’s stock price.

- Corporate Governance: Institutional investors have the power to influence corporate governance decisions through proxy voting. They can vote on issues such as executive compensation, board member elections, and shareholder proposals.

- Market Impact: Large purchases or sales of Apple shares by institutional investors can significantly impact the stock price and market sentiment.

Individual Investors: A Collective Force

While institutional investors hold a large percentage of Apple’s shares, individual investors also play a significant role. Millions of people around the world own Apple stock, either directly or through brokerage accounts. Collectively, their holdings represent a substantial portion of the company’s ownership.

The Power of Retail Investors

The rise of online brokerage platforms has made it easier than ever for individuals to invest in the stock market. This has led to a growing number of retail investors owning Apple stock. While individual holdings may be small compared to those of institutional investors, the collective power of retail investors can be significant. Their trading activity can contribute to market volatility and influence stock prices.

Insider Ownership: Key Executives and Directors

Insider ownership refers to the shares held by Apple’s executives and directors. These individuals have a direct stake in the company’s success and their ownership aligns their interests with those of other Apple stock holders. Insider ownership can be a positive sign, as it indicates that management is confident in the company’s future.

Key Insiders and Their Holdings

- Tim Cook (CEO): As the CEO of Apple, Tim Cook holds a significant number of Apple shares. His ownership reflects his commitment to the company and his belief in its long-term potential.

- Other Executives and Directors: Other key executives and directors also hold Apple shares, further aligning their interests with those of shareholders.

The Significance of Insider Ownership

Insider ownership is often viewed as a positive signal by investors. It suggests that management is confident in the company’s prospects and that their interests are aligned with those of shareholders. However, it’s important to note that insider ownership is just one factor to consider when evaluating a company’s investment potential.

Analyzing Apple’s Stock Ownership Structure

Understanding Apple’s stock ownership structure requires analyzing the percentage of shares held by different types of investors. This information can provide insights into the stability of the stock, the potential for corporate governance influence, and the overall market sentiment towards the company. By looking at the distribution of Apple stock holders, one can gain a better understanding of the company’s financial landscape.

Key Metrics to Consider

- Percentage of Institutional Ownership: A high percentage of institutional ownership can indicate stability and long-term investment potential.

- Percentage of Insider Ownership: A moderate to high percentage of insider ownership can suggest that management is confident in the company’s future.

- Changes in Ownership: Tracking changes in ownership over time can reveal trends in investor sentiment. For example, if institutional investors are increasing their holdings, it could be a positive sign. Conversely, if insiders are selling shares, it could raise concerns.

The Impact of Stock Splits on Apple Stock Holders

Apple has conducted several stock splits throughout its history. A stock split increases the number of outstanding shares while reducing the price per share, without changing the overall market capitalization of the company. Stock splits can make the stock more accessible to individual investors and potentially increase trading volume.

Historical Stock Splits

Apple has a history of stock splits, including a notable 7-for-1 stock split in 2014 and a 4-for-1 stock split in 2020. These splits made Apple’s stock more affordable for individual investors, potentially increasing demand and liquidity.

Benefits of Stock Splits

- Increased Accessibility: Stock splits make the stock more affordable for individual investors.

- Increased Liquidity: Stock splits can increase trading volume and liquidity.

- Positive Market Perception: Stock splits are often viewed as a positive sign by the market, as they indicate that the company is confident in its future growth prospects.

The Role of Stock Buybacks in Apple’s Financial Strategy

Apple has been actively repurchasing its own shares in recent years. Stock buybacks reduce the number of outstanding shares, which can increase earnings per share (EPS) and potentially boost the stock price. Buybacks are a way for Apple to return capital to Apple stock holders.

Impact on Earnings Per Share (EPS)

By reducing the number of outstanding shares, stock buybacks can increase earnings per share (EPS), making the stock more attractive to investors.

Signaling Confidence

Stock buybacks can also signal to the market that the company is confident in its future prospects and that it believes the stock is undervalued.

Dividends and Returns for Apple Stock Holders

In addition to potential capital appreciation, Apple stock holders also benefit from dividends. Apple pays a quarterly dividend, providing a steady stream of income for investors. This adds to the overall return for shareholders.

Dividend Yield

Apple’s dividend yield, which is the annual dividend payment divided by the stock price, is an important metric for income-seeking investors. While Apple’s dividend yield may not be as high as some other companies, it provides a reliable source of income and has grown steadily over time.

Total Return

The total return for Apple stock holders includes both capital appreciation and dividend income. Over the long term, Apple has delivered impressive total returns, making it a popular investment choice.

Future Outlook for Apple Stock Holders

The future outlook for Apple stock holders depends on several factors, including the company’s ability to innovate, maintain its competitive advantage, and navigate macroeconomic challenges. Continued growth in services, expansion into new markets, and successful product launches will be key to driving future returns for shareholders. Monitoring these aspects is critical for understanding the potential trajectory for Apple stock holders.

Key Factors to Watch

- Innovation: Apple’s ability to innovate and develop new products and services is crucial for its long-term success.

- Competition: Apple faces intense competition from other technology companies. Maintaining its competitive advantage will be essential for driving future growth.

- Macroeconomic Factors: Economic conditions, such as inflation, interest rates, and global growth, can impact Apple’s financial performance and stock price.

Conclusion: The Significance of Understanding Apple’s Ownership

Understanding who the Apple stock holders are and the dynamics of Apple’s ownership structure is essential for investors, analysts, and anyone interested in the company’s financial health. The distribution of ownership, the influence of institutional investors, and the role of insider ownership all contribute to the overall picture of Apple’s investment potential. By carefully analyzing these factors, investors can make informed decisions about whether to invest in Apple and how to manage their positions.

Ultimately, being informed about Apple stock holders provides valuable insights into the company’s stability, governance, and future prospects. Whether you’re a seasoned investor or just starting out, understanding Apple’s ownership structure is a crucial step in making sound investment decisions. [See also: Apple’s Financial Performance Analysis] [See also: Investing in Tech Stocks: A Beginner’s Guide]