Navigating Your My Zales Credit Card: A Comprehensive Guide

The My Zales Credit Card offers a convenient way to finance jewelry purchases, but understanding its features and terms is crucial for responsible usage. This comprehensive guide provides essential information about managing your My Zales Credit Card, including application, benefits, payment options, and potential pitfalls.

Applying for a My Zales Credit Card

Applying for a My Zales Credit Card is typically straightforward. You can usually apply online through the Zales website or in person at a Zales store. The application process involves providing personal information such as your name, address, social security number, and income. Creditworthiness plays a significant role in approval, so having a good credit score increases your chances of being approved.

Before applying, review your credit report to ensure accuracy. Addressing any errors beforehand can improve your approval odds. Keep in mind that applying for multiple credit cards within a short period can negatively impact your credit score, so apply strategically.

Benefits of the My Zales Credit Card

The My Zales Credit Card offers several potential benefits, primarily centered around financing jewelry purchases. These benefits may include:

- Special Financing Options: Zales often provides promotional financing offers, such as deferred interest plans, allowing you to make purchases and pay them off over time without accruing interest if paid within the promotional period.

- Exclusive Discounts and Offers: Cardholders may receive exclusive discounts, early access to sales, and other special offers not available to the general public.

- Convenient Payment Options: The card provides a convenient way to make purchases at Zales stores and online.

However, it’s crucial to understand the terms and conditions associated with these benefits. Deferred interest plans, for example, can be risky if not managed carefully. If the balance is not paid in full by the end of the promotional period, interest is typically charged retroactively from the date of purchase. [See also: Understanding Credit Card Interest Rates]

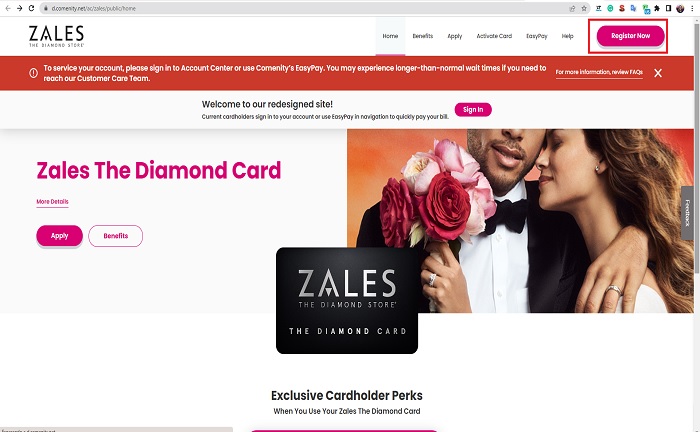

Managing Your My Zales Credit Card Account

Effective management of your My Zales Credit Card account is essential to avoid late fees, interest charges, and potential damage to your credit score. Here are some key aspects of account management:

Making Payments

Zales offers multiple payment options for your My Zales Credit Card. You can typically make payments online through the card issuer’s website, by mail, or by phone. Setting up automatic payments can help ensure you never miss a due date. Always pay at least the minimum amount due, but paying more than the minimum can significantly reduce interest charges and help you pay off your balance faster.

Monitoring Your Account

Regularly monitor your account activity online to track your spending, check your balance, and identify any unauthorized transactions. Sign up for email or text alerts to receive notifications about your account activity, such as payment due dates and credit limit updates.

Understanding Your Credit Limit

Be aware of your credit limit and try to keep your balance well below it. Utilizing a high percentage of your credit limit can negatively impact your credit score. [See also: Improving Your Credit Score]

Potential Pitfalls and How to Avoid Them

While the My Zales Credit Card can be a useful tool, it’s important to be aware of potential pitfalls:

- High Interest Rates: Store credit cards often have higher interest rates than general-purpose credit cards. If you carry a balance, interest charges can quickly add up.

- Deferred Interest Plans: As mentioned earlier, deferred interest plans can be risky if not managed carefully. Make sure you understand the terms and conditions and have a plan to pay off the balance before the promotional period ends.

- Limited Use: The My Zales Credit Card can only be used at Zales stores and online. This limited use may make it less versatile than a general-purpose credit card.

To avoid these pitfalls, use the card responsibly, pay your bills on time, and avoid carrying a balance. Consider using a general-purpose credit card with rewards for purchases outside of Zales. The My Zales Credit Card can be a helpful resource, but responsible use is vital.

Alternatives to the My Zales Credit Card

Before applying for the My Zales Credit Card, it’s worth considering alternative financing options:

- General-Purpose Credit Cards: These cards offer more flexibility and can be used anywhere credit cards are accepted. Many offer rewards programs, such as cash back or travel points.

- Personal Loans: If you need to finance a large purchase, a personal loan may offer a lower interest rate than a credit card.

- Savings: Paying with cash or savings is always the most cost-effective option.

Frequently Asked Questions About My Zales Credit Card

How do I check my Zales credit card balance?

You can check your My Zales Credit Card balance online by logging into your account on the card issuer’s website. The website address is typically provided on your billing statement or on the back of your card. You can also call the customer service number to check your balance over the phone.

What is the interest rate on the My Zales Credit Card?

The interest rate on the My Zales Credit Card varies depending on your creditworthiness. The specific interest rate applicable to your account will be disclosed in your credit card agreement.

How do I make a payment on my My Zales Credit Card?

You can make a payment on your My Zales Credit Card online, by mail, or by phone. To pay online, log into your account on the card issuer’s website. To pay by mail, send a check or money order to the address provided on your billing statement. To pay by phone, call the customer service number and follow the prompts.

What if my My Zales Credit Card is lost or stolen?

If your My Zales Credit Card is lost or stolen, report it immediately to the card issuer. You can typically report a lost or stolen card online or by phone. The card issuer will cancel your old card and issue a new one. You will not be responsible for any unauthorized charges made after you report the card lost or stolen.

Conclusion

The My Zales Credit Card can be a useful tool for financing jewelry purchases, but it’s important to understand its terms and conditions and use it responsibly. By managing your account effectively, paying your bills on time, and avoiding carrying a balance, you can avoid potential pitfalls and maximize the benefits of the card. Remember to consider alternative financing options and compare interest rates before applying. This comprehensive guide has provided you with the knowledge necessary to navigate your My Zales Credit Card with confidence. Understanding the nuances of the My Zales Credit Card is key to making informed financial decisions. The responsible use of your My Zales Credit Card will help you achieve your goals. Make sure to keep track of your My Zales Credit Card spending and payments. The My Zales Credit Card can be a great tool when used wisely. Don’t hesitate to contact customer service if you have questions about your My Zales Credit Card. Using your My Zales Credit Card responsibly builds credit. The My Zales Credit Card offers financing for jewelry purchases. Consider the benefits of the My Zales Credit Card before applying. Always pay your My Zales Credit Card bill on time.